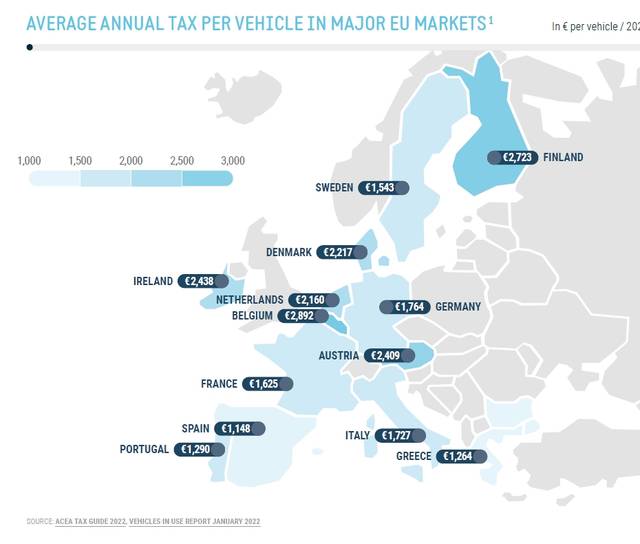

Divided Europe (on car taxes) – The taxes Not popular at all. However, behind this name, there are hundreds of different taxes and rates, but under this complexity, there are taxes imposed the cars They are undoubtedly an important part. Cars are families’ second largest investment, after a home investment, so the relevant tax portion is worth a closer look. Looking at the European Union, we discover, for example, that Italy is not among the countries that They tax more cars. The unenviable scepter belongs to Belgium: In fact, its citizens spend an average of €2892 per year per vehicle, with Finland To continue with 2723 euros andIreland On the podium with 2,438. L ‘Italia Almost in line with other big countries because 1727 Annuals midway between 1764 from Germany and 1625 from France. You can save in Greece and Spain, which are the cheapest: (1,264 and 1,148 euros respectively) and pay a lot more in Austria and Denmark, in fourth and fifth places with 2,409 and 2,217 euros. We note that countries such as Hungary, Croatia or the Baltic republics are excluded from this comparison due to lack of data. These figures (provided by the European Manufacturers Association ACEA) should be to provide more complete information relating to purchasing power and average income but are nonetheless indicative.

Savings in the Russian mountains – Other interesting data are those ontax rate applicable to the price the carsIt extended to all countries of the Union, which amend the papers. Hungary is the most expensive: 27% in momentum surpasses Croatia, Denmark and Sweden (25%) and 24% by Finland and Greece. However, somewhat down the line, 22% of Italy and Slovenia pale in comparison to 17% of Luxembourg, 18% of Malta and 19% of Germany, Cyprus and Romania. Our country (unfortunately) takes revenge on excise duties: the data before the government intervenes to calm prices (over here Learn more) They speak clearly. Italy actually has a European record Excise tax on diesel – 610 euros per 1000 liters 61 cents a liter – second only to gasoline, 72 cents a liter. Hungary, which has a priority VAT rate, is the least expensive for both fuels (35 cents for gasoline and 32 cents for diesel). Behind Hungary in terms of economy of fuel tax levies we find Poland, Malta and Bulgaria (second, third and fourth, respectively) while the highest diesel taxes, after Italian, are owed to Belgium, France and Ireland. The record oil tax fee, 82 cents per liter, is in the Netherlands, followed by Italy and Finland, Greece and France.

happy tax – These taxes and fees brought a flood of money to the state treasury and ACEA I make a table with this data which unfortunately is not homogeneous given that some refer to 2019, some refer to 2020 (the year of the pandemic) and some refer to 2021. taxes 89.7 billion in Germany and 73.4 billion in France. their contribution to Italian tax revenue (Data for 2019) was 76.3 billion, down to 34.1 for Spanish in 2021. It’s also interesting to separate the different elements that make up it from the absolute numbers. Revenues from taxes on fuels and lubricants in Germany and Italy were almost identical at 37.7 and 37.3, respectively: Germany certainly “consumes” more but has lower tax charges. The greater consistency of the German fleet – in 2019 it was 51.60 million vehicles against 44.76 in Italy – and different taxes appear taking into account, for example, revenue from value-added tax on sales services, repairs and spare parts – 29, 1 billion against 18.9 in Italy billion – And insurance taxes, which amount to 5.5 billion against 3.9. Total annual revenue in major European markets is ultimately €375 billion, which is an astronomical figure.

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”