Inflated capital gains in football: facts, figures and analysis

In 2013, the world of football revolutionized the world of football Financial fair play. All UEFA’s goals were honorable: the kickoff debt erosion Convincing teams to follow the path of sustainability through self-financingReducing the level of indebtedness, and favoring investment in infrastructure and in better management of nurseries for young players.

The role of the balanced budget

And so on balanced budget which requires clubs to have balanced costs and revenues, subject to exceeding the maximum backlog 30 million every three years (Shareholder contributions do not count as income). Initially, the results were positive, in fact the economic and financial health of the football leagues in England, Spain, Italy, Germany and France improved. But the road to hell, as we know, is paved with good intentions. And so on Financial fair play It may have caused unwanted side effects of Resorting to illegal financial policies Like bloated capital gains. over there Pressure to reach the goal economic and financial It would have enabled the teams to resort to illegal budgetary policies. over there CONSOB e Kovesuk They are investigating 64 transitional market operations considered “suspicious” in the Italian championships. The suspicion is that player transfers are not related to sporting issues but are driven by the need to improve economic performance.

The teams involved in the investigation

the KovesukThe Supervisory Committee of Professional Football Clubs of the International Federation of Football Associations (FIGC) evaluates the transactions that Italian League teams worry Come NaplesAnd GenoaAnd Sampdoria, Juventus so Empoli. With Genoa, Juventus, from 2018 to 2020, made operations of about 123 million euros, while Inter, since 2018, completed six operations with Genoa for 78 million euros.

Inflated capital gains: the impact of financial fair play?

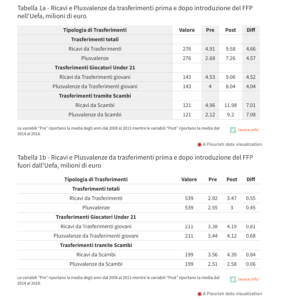

Mr Massimiliano Bonacci, Professor of Business Economics at the Free University of Bolzano with Prof. Fabio Siabone, researcher at the University of L’Aquila, and professor. Antonio MaraAssociate Professor of Accounting and Financial Reporting at Bocconi University in the study The unintended consequences of accounting regulation: the real impacts on the transfer market for European footballers Posted in SSRN with the professor. Ron Shalev From the University of Toronto, analysis Transform campaigns and budgets Of the clubs participating in the “Italian League” tournaments of the five major leagues (England, Spain, Germany, Italy, France) from 2008 to 2018. The study, summarized by A. Massimiliano BonacciAnd Fabio Siabone e Antonio Mara for him lavoce.info, analyzes 815 financial statements and 4,626 player sales deals. The data shows how, after the entry into force of the Ffp for clubs participating in UEFA competitions only, transfer campaigns changed structurally and the number of clubs making capital gains increased in order to comply with the balanced budget constraints imposed by law.

Increase average conversion revenue

According to the study data, the average player transfer revenue per team is growing 4.66 million for clubs participating in UEFA competitions compared to 0.55 million for citizens. Average Return on Transfer Nursery players maximizing capital gains Because the budgeted cost is zero. In this case they double for UEFA clubs and increase by just under a quarter for national clubs. Moreover, the average transfer gain (recorded capital gain), starting with similar values before law enforcement (2.68 vs. 2.55 million) grows a lot, for UEFA clubs alone, by 2.7 times (2.68 to 7.26) million), peaking more than 4 times (from 2.12 to 9.2 million) in the case of transactions concluded with player exchanges.

Extensive use of “mirror” exchanges

These are the last operations.in the mirrorWhere two teams agree to exchange two or more players Overestimation of its true market value In order to include asset values in their balance sheets that are higher than they were previously, without a real flow of money between the parties. In these transfers, the gap between the transfer price and the potential “market value” of players has increased by about 20% after the introduction of the new UEFA rules. Consop and prosecutors are specifically investigating this specific type of capital gain.

Opportunistic capital gains to balance budget

Business thesis that cause capital gains”opportunism“That is, those not attributable to sporting purposes lie in the search for a balanced budget.” Before the introduction of Ffp – write the academics – “the proportion of suspicious companies was similar to UEFA and non-UEFA teams, respectively at 29 and 26 per cent, after submitting Ffp, UEFA teams have been making more use of capital gains.” This way 52% of UEFA teams break even compared to about 30% of non-UEFA teams.

FIFA reform proposal

Capital gains, however, are not evil. If behind the capital gains there Real player enhancement, are elements that are part of a virtuous business model. over there FIFA, we read in the site “Lavoce.info”, studying “an algorithm that allows you to determine the economic value of a player in a less estimated way”. The study’s academic authors suggest looking at “proven systems such as those of the NFL (National Football League) and the National Basketball Association (NBA), in order to better organize data and rethink financial fair play.”

Newsletter Subscription

Subscribe to our mailing list to receive our newsletter

“Alcohol enthusiast. Twitter ninja. Tv lover. Falls down a lot. Hipster-friendly coffee geek.”