Unexpected cold winds from Canada enter the United States, drastically increasing the risk premium for warming, resulting in the largest weekly drop in inventory in a year at the height of winter.

Gas futures in New York’s Henry Hubl rose nearly 10% in yesterday’s trade, adding to the 9% increase in the previous two sessions as European and US GFS weather systems begin to calculate the strength of the cold coming from Canada.

Those familiar with meteorological models expect this change to lead to a 44 billion pcf increase in gas demand over the next two weeks if forecasts prevail.

“Significant surges in expected demand are certainly being observed by markets,” said Dan Myers, analyst at Kelber & Associates in Houston, about yesterday’s rally.

And he adds:

“The renewed volatility is a reminder that winter is not over yet and there is a risk of further reversal in the short term.”

Myers’ comments come ahead of the weekly US update, which will be released by the Energy Information Administration (EIA) at 10:30 p.m.

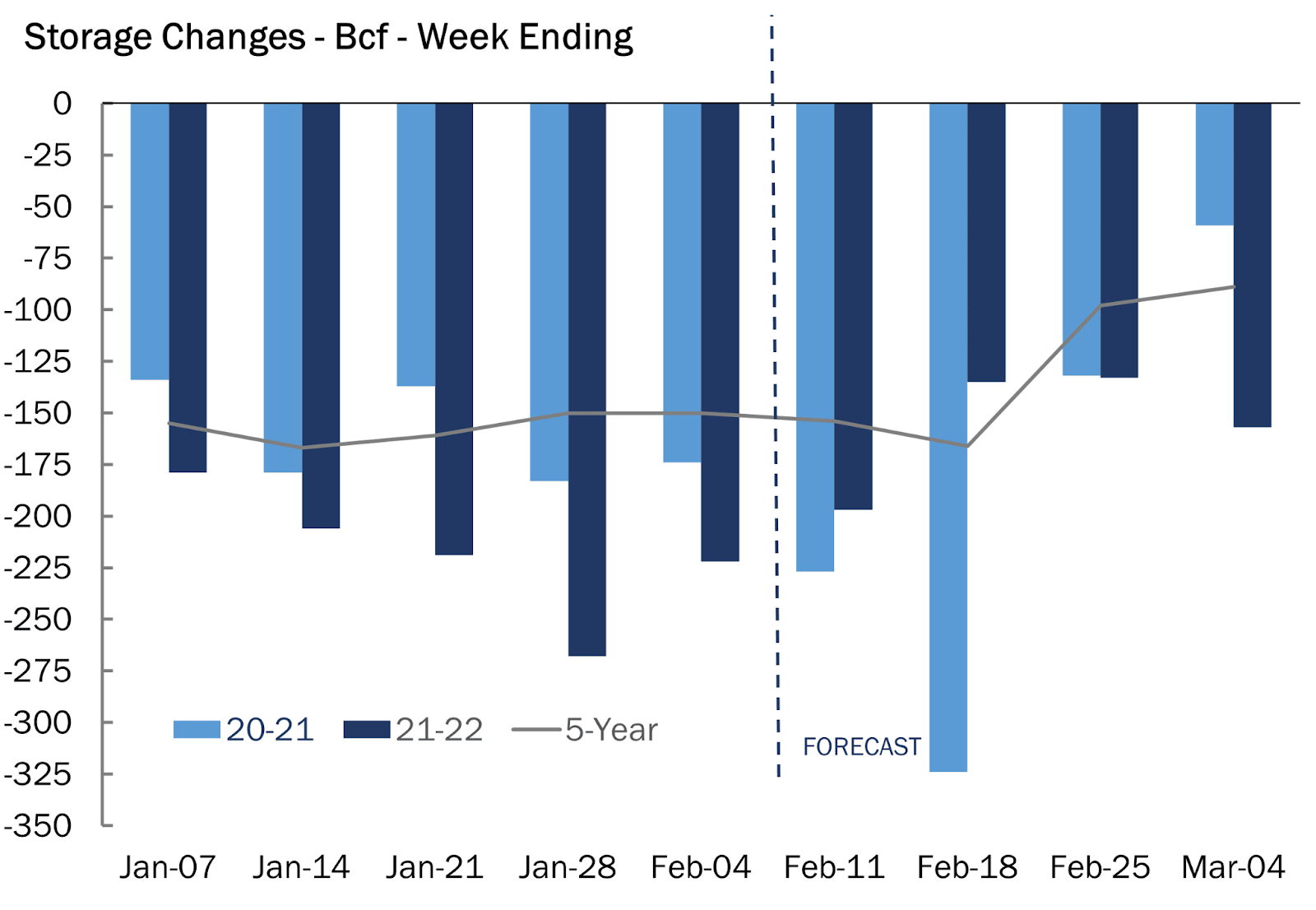

For the fifth week in a row, the EIA is expected to report usage equivalent to or more than 200 bcf of inventory gas as Americans shift their heat from east to west to the nation’s freezing temperatures.

For the week of February 11, the researchers followed Investing.com They expect a reduction of 193 pcf.

“Consumption of nearly 200 bcf is still very high and expectations for lower-than-average reductions, even if already taken into account, contribute to a good performance,” Myers wrote in an email to Gelber &’s customers yesterday. Allies.

Forecasting company NatGasWeather agrees. “Clearly, cold trends will lead to a deficit of about 250 pcf and increase in early March,” he said in a forecast on naturalgasintel.com.

The use of 193 bcf last week was 227 bcf in the same week a year ago, compared to the five year average (2017-2021) of 154 bcf used.

During the week of February 4, 222 pcf of stock gas was used.

Source: Kelber & Associates

Analysts’ estimates if asked from Investing.com Prove correctly, total inventory is expected to fall to 1.908 trillion cubic feet (tcf), which is about 11.7% lower than the five-year average and 17.6% lower than last year’s volume.

According to Refinitiv’s data, last week’s temperatures were cooler than normal, compared to the 175 HDDs’ 183 HDDs compared to the 30-year standard.

HDDs measure the average daily temperature below 65 degrees Fahrenheit (18 degrees Celsius) and are used to estimate heat demand for homes and offices.

Last week’s decline is likely to be exacerbated by a freeze on gas production due to the severe cold in the United States.

Canadian imports also declined, estimated at about 0.6 bcf per day on a weekly basis.

According to estimates released by naturalgasintel.com, NatGasWeather notes that the worsening winter weather in the eastern United States has offset the free fall in gas prices since last week.

As the spa unit has risen nearly 80 cents to $ 4.70 in recent sessions, the company says “clearly the natural gas markets are welcoming additional demand.”

“Will even cooler trends be enough to test prices at $ 5?” He asks.

EBW AnalyticsGroup, a leader in liquefied natural gas (LNG), seems to be turning a blind eye to the growing demand for exports.

The company notes that for the first time in the last six days, demand for gas from US LNG export facilities has exceeded 13 bcf in five days.

By entering Venture Global LNG’s Calcassie Pass plant service, U.S. The amount of gas sent to LNG export facilities has so far averaged 12.7 pcf per day in February, up from 12.4 pcf in January.

Note: Parani Krishnan uses different perspectives in addition to his own to bring diversity to the analysis of each market. Outside of neutrality, it sometimes presents counter-opinions and market variables. It has no position on any of the materials or assets it writes about.

“Total coffee junkie. Tv ninja. Unapologetic problem solver. Beer expert.”