The US Federal Debt Ceiling: What is happening and what are the scenarios. The analysis was conducted by Roberto Rossignoli, Portfolio Manager at money farm

“We will have an economic and financial disaster.” And so US Treasury Secretary Janet Yellen commented on the US debt situation, recalling how it is Congress’ express job to ensure that does not happen, by raising the debt ceiling – or debt ceiling To provide long-term certainty and ensure that the government is able to make payments.

the debt ceiling It is basically a tool for controlling American public finances that was created in 1917. Prior to that, every debt issue had to be authorized by Congress. However, to cover the costs associated with entering the war, the US government needed greater flexibility, so the legislative process was modified to be able to resort to debt more easily, but within predetermined limits. since then debt ceiling It is the primary tool by which Congress can control government spending.

The situation in the United States is currently critical. According to Yellen’s predictions, if a solution is not found, the United States may risk default as early as June. A deadline that not all members of the US Congress agree upon. In fact, the problem turned out to be political, given that there is still time for the Republicans (presumably in July or August) and therefore there will be no need to make concessions for the time being. The Treasury Department misunderstood the intransigence, which brought up the issue of the debt-limit-raising quandary to board members of the Bank Policy Institute, an organization led by JPMorgan Chase CEO Jamie Dimon, whose CEO, Jane Fraser, also sits at Citigroup.

How did you come to this point of view?

Over the past 30 years, the debt ceiling has been raised several times, with greater frequency and intensity during crises, such as the 2008 and 2020 crises.

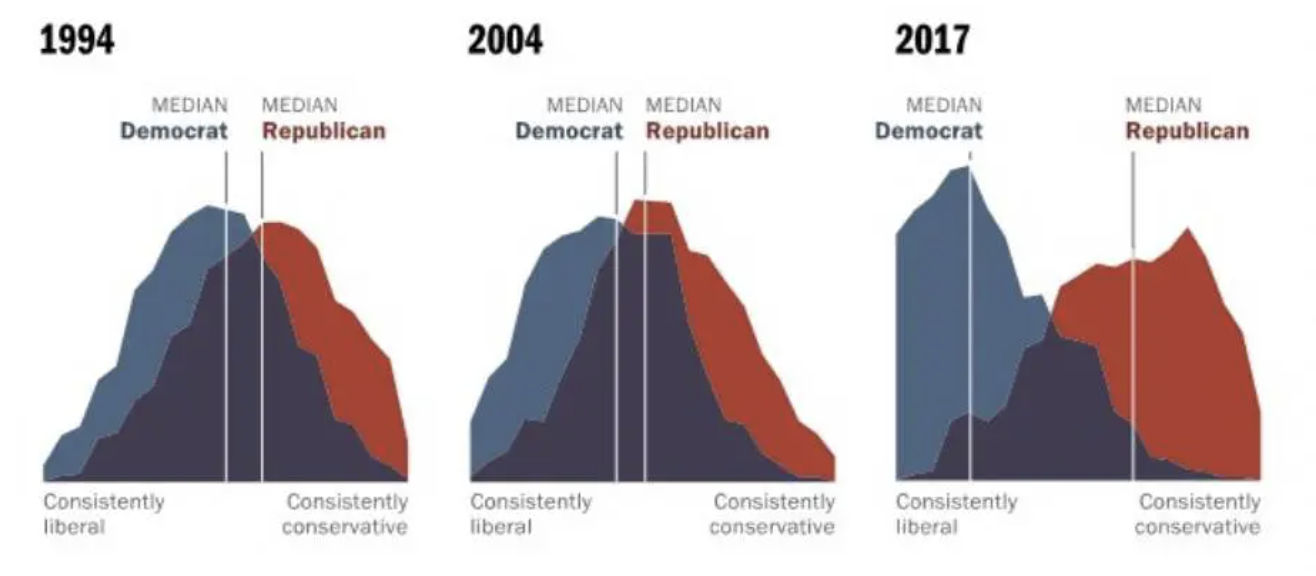

What makes the current context potentially controversial and dangerous is the significant polarization of the electorate, and thus of the political structure in Congress. This makes mediation to resolve your debt problem more difficult.

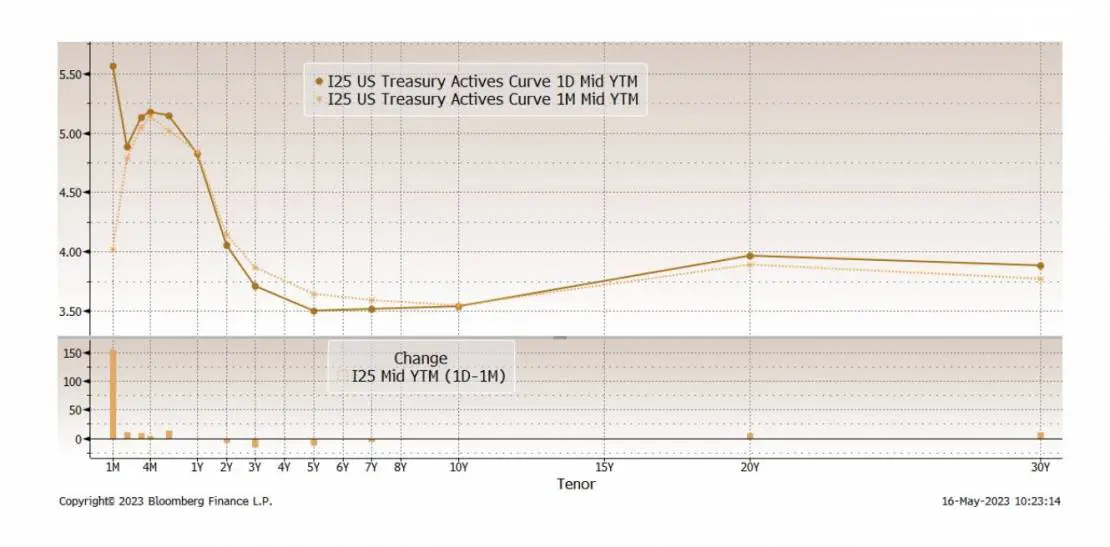

From a financial markets perspective, we are seeing interesting divergence between money and bond market prices on this event and the moves in stocks. Money and bond markets are beginning to include the possibility that the government may not be able to pay bonds due in June, an event reflected in two clues. The first is that the probability of a rate cut by the Fed has increased: although the central bank is independent of the Treasury, it is difficult to imagine that there would be no favorable shift in monetary policy in the event of debt stress. The second is the slope of the interest rate curve. The chart below clearly shows how the interest rate investors requested last month on US government bonds due in one month was exceptionally high, especially in the past month.

Stock markets are rallying relentlessly at the moment, without giving too much importance to the possibility of default. This makes sense in part, because investing in stocks usually involves a multi-year time horizon, but on the other hand, it rings alarm bells about investors’ ability to consider these types of risks. At the moment there is no consensus on the “expiration date” of the Stars and Stripes sheet. The proven fact is the speed with which the US government has depleted its reserves at the Federal Reserve Bank in recent months.

Since May 2022, the balance has decreased by 810 billion, depleting the excess liquidity created by Covid. The level itself is not abnormal compared to pre-pandemic data, but with regard to public spending and debt increase, the situation is more serious than it was in the past. In fact, it is estimated that spending on interest payments for this year alone will be worth about $900 billion. Some analysts see the first half of June as the key period when there is a big fiscal deadline that could fill the country’s coffers, but it may already be too late. Other analysts push the expiration date later in the summer. What is certain is that the consequences of default, even if they are purely technical, will be very serious. For this reason, the success of the negotiations (which remains our primary condition) becomes paramount and the situation should not be underestimated.

Newsletter Subscription

Subscribe to our mailing list to receive our newsletter

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”

Leave a Reply