Another study, another correction. Downline. Atlanta Federer’s GDPNow update, a real-time GDP tracker, sets the pace again today: The US economy grew by only + 0.2% in the third quarter 0.5% last week and 1.2% on October 15. But, above all, + 6% in August and + 14% in May. In fact, in real terms, the trend is already negative.

Despite the blue part of the map,

Evolution of real-time monitoring of US GDP (3 quarters)

Source: Atlanta Fed

Related to Investment Bank Ratings, Still GDP sees less than 4%. Not for long, probably. This is because of the decline in industrial exports, which saw US exports fall 4.7% in August after an all-time high. Goldman Sachs cut last quarter’s growth estimates to 2.75%. All in an environment that seems complicated day by day. The Stockflation hypothesis will now officially appear on the tableOn the other hand, the central bank is forced to publicly uphold its promise to reduce the epidemic program from mid-November or mid-December until recently. All of this within a week of the next currency group scheduled for November 2nd and 3rd, Was forced to provide a definitive version of what to do in the market at this point.

Purchase reduction already priced by increase in yield And its own support while waiting for a new round of happy-go-round, from one Wall Street, between quarter and Tesla style wing strokes, from another place? Soon it will be discovered. Meanwhile, Canada’s neighbors noticed the delay. In fact, the Bank of Canada has announced its intention to terminate its QE early, currently set at $ 2 billion per week. And can give life to a dynamic such as that indicated on the map in response to infection.

Evolution of the Bank of Canada’s balance sheet

Fonde: Bloomberg

Moreover, as inflation intensifies, the central bank is forced to raise its estimates for both the current year and 2022 to 3.4%. Ottawa is preparing for its first fare hike in April and early May next year. The 2-year Canadian bond yield rose 24 basis points to more than 1%.

And ECB, what will it do tomorrow? It will continue with a description of the volatility of inflation, effectively linking the market to limited and vague promises. Measure again Purchase or compulsion goes against the four trends, Does PEPP seem intent on transforming itself into a legitimate and permanent tool after March 31? On the one hand, the surprising resignation of Jens Weidman from the leadership of the Bundesbank (and from the leadership of the hawks in the group) would support the second hypothesis. Especially if the news comes from Germany The Ministry of Economy has downgraded its GDP estimate for the current year to 2.6 percent from 3.5 percent in April..

Apparently, it is trying to offset the move by an upward correction of growth for 2022, which went from 3.6% to 4.1%. On the other hand, it costs nothing to shoot promising figures. The problem now is to make the formal downward corrections digestible. But the opposite is scary with this map,

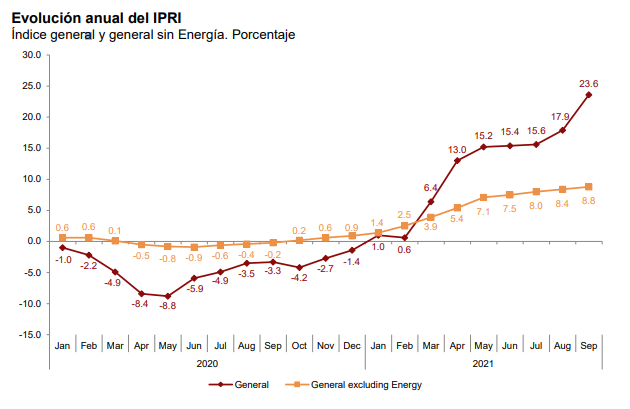

Evolution of manufacturer prices in Spain

Fonde: Bloomberg

Shows how Manufacturer prices in Spain rose 23.6% in September, the largest increase since 1977 to 5.5% yoy., The biggest improvement ever since the time series was planned.

What to do then? Macro reality shows clear signs of recession in China, with signs for this effect from China (as well as the US). So it would be intuitive to think of the pigeon pose, At least to calm markets and especially spreads, already on a determined path of tension. On the other hand, inflation is starting to fluctuate more than a buckwheat e The central bank itself has officially dropped its report on the transition, Clarifies how to speak openly about a trend that will last for a good part of 2022 A gamble Encouragement In the event of a prolonged pep it may actually ignite the powders.

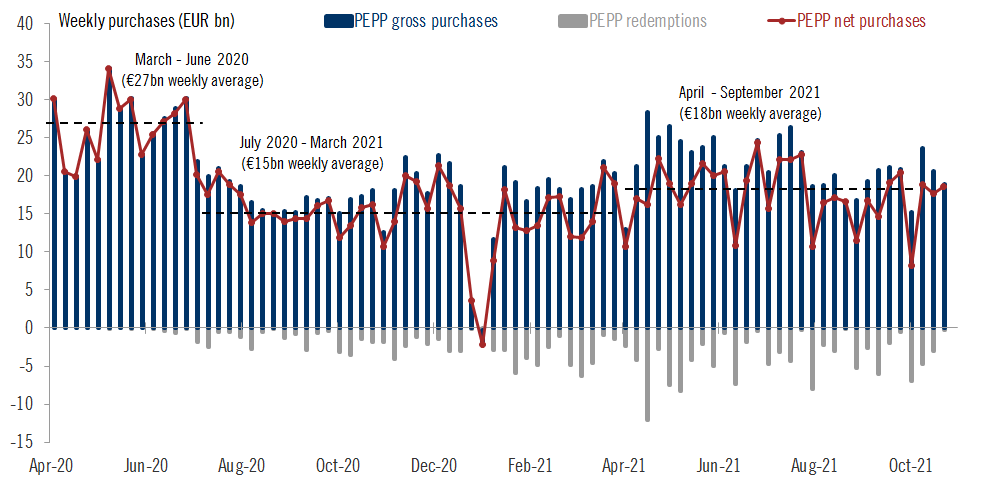

This is the last map

Trend of opposite values of weekly pep purchases

Source: Pictet / ECB

It seems to expose a reality known to all, but officially denied by all: despite the fact that we have now entered the third week of the last quarter of the year, Eurodavar’s weekly purchases are fully compatible with previous two quarters of purchases. In fact, the net worth of the last session of intervention 18.6 billion is higher than average Recoveries. Despite this, the spreads are trembling. One of the leading Italians.

So be careful. The ECB was less expected in the media and called to trumpet, but more important since the outbreak began: Avoid – even in language and emotion – the policy error that provokes the storm, already boiling on the horizon. In fact, Transylvanian Christine Lagarde, The Wrong step. In short, ECB-related discharge that is not included in the task of calming the spreads can unleash hell..

“Total coffee junkie. Tv ninja. Unapologetic problem solver. Beer expert.”

Leave a Reply